The Fibras, measured by the S&P/BMV Fibras sector index, are recovering their strength. So far this year and during the first quarter, they have generated gains in their listing on the Mexican Stock Exchange (BMV), where they accumulate a return of 9.1% between January and March 2023, even in the midst of rate increases. of interest.

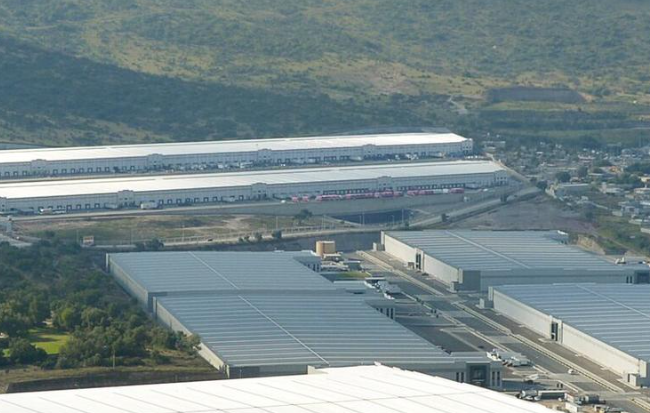

Roberto Solano, stock market analysis coordinator at Monex Casa de Bolsa, commented that despite the challenges faced by real estate investment trusts (Fibras) in the economic sphere due to interest rates and inflation, they are already reporting outstanding results such as occupation up to 100% in some real estate markets in the industrial segment.

Of interest: The impact of the low vacancy rate in Mexico City on industrial demand

During the first three months of 2023, for the most part, industrial fibers are the ones that accumulated the highest performance in the stock market. Although FibraHotel led the stock market gains, with a return of 30.71%, it was followed by Prologis (+18.71%), Terrafina (+16.80%); Fibra Uno (+9.63%) -the firm operates 6 million square meters of industrial space, without counting other segments-.

While the industrial sector leads the demand for spaces; The commercial sector is recovering, as is the hotel sector, and some have even overcome the lag generated by the closures decreed from the Covid-19 pandemic due to greater mobility of people. The office sector is validating "the longed-for turning point" in its occupancy rates.

Consult here: Solili Industrial Report 1Q 2023, industrial demand in Mexico grew 47% compared to 1Q 2022

Armando Rodríguez, general director of Signum Research, added that the clear recovery in the occupancy rates and in the income of the Fibras should translate into higher income and attractive distributions. Fluctuations in the exchange rate and inflation will continue to affect the performance of these real estate investment figures.

Although he emphasized that the record interest rate cycle is close to ending, so by 2024 this factor will no longer play against real estate trusts. While for the Fibras that have liabilities in foreign currency there is an exchange gain due to the appreciation of the exchange rate, which may result in better distributions.

In Solili you can consult industrial warehouses in Mexico City, Monterrey and Ciudad Juárez

Stay up to date with the most important news to the real estate

Subscribe Solili Newsletter